How Fleets Can Easily Remove Crash Preventability Off CSA Scores

CNS can help with our Roadside & Incident Report Management service where a team of DOT Compliance Specialists will assess the Department of Transportation safety records

We are a team of DOT Compliance and Licensing Professionals helping trucking and transportation companies remain safe, compliant, and profitable.

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

A full-scale DOT Compliance Program managing a long haul carrier’s safety, compliance, licensing and more.

Learn more >>>

A DOT Compliance Program that keeps motor carriers compliant with the 6 Basic DOT Regulations required of all carriers.

Learn more >>>

Our Short-Haul/Construction Program is a full-scale program designed for private carriers that do not haul for-hire.

Learn more >>>

Our most comprehensive DOT Compliance Program, operating as your company’s off-site Safety Director or assisting your current safety personnel.

Learn more >>>

Our Non-CDL Program is a full-scale program managing safety, compliance, licensing and more for moving companies, couriers, landscapers, or any company subject to DOT regulations and does not employ CDL drivers.

Learn more >>>

Our DOT Audit Services cover a number of different types of DOT Audits that new and existing carriers will be subject to.

Our DOT Driver Services help trucking companies and carriers to stay compliant as they grow and hire more drivers.

Our DOT Vehicle Services focus on ensuring your vehicles are compliant with DOT Regulations, which is just as important as your drivers.

Our DOT Services for Special Carriers focus on companies outside of the typical motor carrier, like HAZMAT, Passenger and Bus Carriers.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

Our DOT Licensing Services will cover you whether you are an existing company or just starting a trucking company. Our DOT Licensing Specialists can help you get up and running and in days with your DOT number, MC Authority, EIN, UCR, IFTA, 2290 HVUT, Fuel Taxes and can even set you up to get your Commercial Driver's License (CDL) with CNS Driver Training Center.

Our DOT Licensing Specialists will help you with every aspect of starting a trucking company. All you need to do is choose a name for your trucking company.

You will need to ensure your DOT Number, MC Authority, Vehicle Registration, etc. is all set up properly when you start your trucking business.

Our Licensing Specialists can help with all aspects of filing and renewing licenses, fuel taxes, etc.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

CNS can help with our Roadside & Incident Report Management service where a team of DOT Compliance Specialists will assess the Department of Transportation safety records

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

CNS Companies is a network of companies specializing in services related to the transportation, manufacturing, construction, service, education and medical industries. Our DOT Compliance division is handled by Compliance Navigation Specialists, CNS Insurance handles Commercial Truck Insurance, CDL training is managed by the CNS Driver Training Center and healthcare is managed by CNS Occupational Medicine.

We are a team of DOT Compliance and Licensing Professionals helping trucking and transportation companies remain safe, compliant, and profitable.

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

A full-scale DOT Compliance Program managing a long haul carrier’s safety, compliance, licensing and more.

Learn more >>>

A DOT Compliance Program that keeps motor carriers compliant with the 6 Basic DOT Regulations required of all carriers.

Learn more >>>

Our Short-Haul/Construction Program is a full-scale program designed for private carriers that do not haul for-hire.

Learn more >>>

Our most comprehensive DOT Compliance Program, operating as your company’s off-site Safety Director or assisting your current safety personnel.

Learn more >>>

Our Non-CDL Program is a full-scale program managing safety, compliance, licensing and more for moving companies, couriers, landscapers, or any company subject to DOT regulations and does not employ CDL drivers.

Learn more >>>

Our DOT Audit Services cover a number of different types of DOT Audits that new and existing carriers will be subject to.

Our DOT Driver Services help trucking companies and carriers to stay compliant as they grow and hire more drivers.

Our DOT Vehicle Services focus on ensuring your vehicles are compliant with DOT Regulations, which is just as important as your drivers.

Our DOT Services for Special Carriers focus on companies outside of the typical motor carrier, like HAZMAT, Passenger and Bus Carriers.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

Our DOT Licensing Services will cover you whether you are an existing company or just starting a trucking company. Our DOT Licensing Specialists can help you get up and running and in days with your DOT number, MC Authority, EIN, UCR, IFTA, 2290 HVUT, Fuel Taxes and can even set you up to get your Commercial Driver's License (CDL) with CNS Driver Training Center.

Our DOT Licensing Specialists will help you with every aspect of starting a trucking company. All you need to do is choose a name for your trucking company.

You will need to ensure your DOT Number, MC Authority, Vehicle Registration, etc. is all set up properly when you start your trucking business.

Our Licensing Specialists can help with all aspects of filing and renewing licenses, fuel taxes, etc.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

CNS can help with our Roadside & Incident Report Management service where a team of DOT Compliance Specialists will assess the Department of Transportation safety records

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

CNS Companies is a network of companies specializing in services related to the transportation, manufacturing, construction, service, education and medical industries. Our DOT Compliance division is handled by Compliance Navigation Specialists, CNS Insurance handles Commercial Truck Insurance, CDL training is managed by the CNS Driver Training Center and healthcare is managed by CNS Occupational Medicine.

Will a $3.6 Billion investment on Semi ever make the company money?

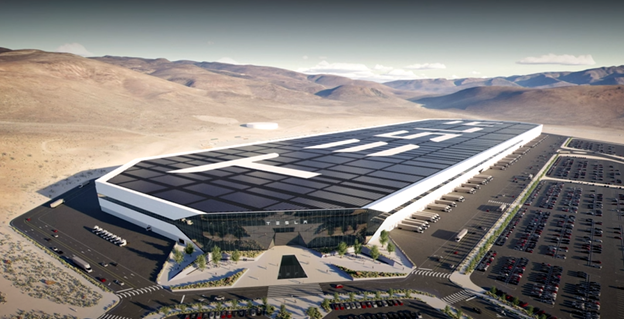

In 2014, Tesla made a commitment to invest $3.5 billion in Nevada with their first Gigafactory and a goal to producing 35 GWh of battery cells annually or enough to manufacture about 500,000 vehicles per year.

This was achieved with just half their factory site and has announced on January 24th, that they will expand this site to include high-volume production of the Tesla Semi.

The Tesla Semi is a day-cab unit that will focus on local and regional routes, not long-haul, with a range of 500 miles fully loaded with a Gross Vehicle Weight of 82,000 lbs (regulations allow 2,000 pounds extra for electric trucks).

New charging technology allows the truck to gain 70 percent state of charge in just 30 minutes.

On top of this, Tesla is working with Semi customers to utilize solar power, megapack storage, and charging stations.

So, what does this expansion mean for the trucking industry?

After a three-year production delay, Tesla semi production began in October 2022 and just held a delivery event for PepsiCo on Dec 1st.

In 2023, Tesla will see limited production of the Tesla Semi at a production site near Giga Nevada that can produce around 5 Tesla Semis per week (260 per year).

However, Tesla has extraordinary demand for the Tesla Semi and has the battery backlogs it needs to make use of this new factory.

Elon said they hope to achieve volume production sometime in 2024, which is expected to be 50,000 Semis per year in North America.

As on June 2023, Elon said he doesn’t see higher volume production until late 2024 due to battery supply constraints. We are still waiting for Giga Nevada expansion to help remedy these supply constraints.

The company would like to offer a Tesla Semi in other markets as well but would be locally produced in the Asia or Europe with a slightly modified version to meet local requirements.

So, what will the factory expansion look like?

Currently, Giga Nevada produces 7.3 billion Panasonic battery cells or equivalent to 37 GWH+ annually. The site has also produced 1.5 million battery packs, 3.6 million drive units, and 1 million energy modules.

But now, Tesla plans to fill out the other half of their Giga Nevada site.

Conservatively, Tesla plans to invest an additional $3.6 billion into a 4 million square foot manufacturing space.

This is on top of their current 5.4 million square feet currently and will add an additional 3,000 jobs beyond their 11,000 employees currently.

The new manufacturing space will include two new factories:

At 50,000 units per year, Tesla would become the second largest manufacturer of Class 8 trucks in the US, after Freightliner (Daimler), which produced about 100,000 in 2022. Kenworth is smaller with roughly 42,000 units.

U.S. and Canada Class 8 truck industry retail sales for 2023 are estimated to increase to a range of 260,000-300,000 vehicles.

Many thought this truck was impossible to make and still argue that it will not impact the trucking industry much.

But, it is now on the road. So, the question comes down to: Is this $3.6 billion investment for Semi production too expensive when they only plan to build 50,000 units per year?

Well, let us break this down.

First, some assumed calculations:

So, what about production supply, such as the lithium needed for the truck?

Well, around Tesla Battery Day in 2020, Elon mentioned the company purchased the rights to 10,000 acres of lithium clay deposits in Nevada where they hope would help eventually reduce costs by 33% in battery production.

These lithium fields will take several years to get up and running.

At the same event, Drew Baglino, Tesla’s senior vice president of engineering, shared that the carmaker will be building its own cathode plant and lithium conversion facility that will cut both production costs and the resources needed to bring materials together.

This permit process may take years to complete, but this would reduce the costs, vertically integrate supply, for a massive need in the Tesla Semi production.

In the end, these trucks will be on the road and the technology will only improve over time.

Now the question is, how many will your fleet try to get?

[Related: Pennsylvania DEP initiative Pushes EV Semi-Trucks With $12.7 Million Grant Program]

All fleets need to conduct proper and thorough pre and post trip inspections, which consists of implementing quality:

All of this will help prevent being a target for the DOT at roadside inspections and is a valuable resource to ensure a healthy fleet, and compliant safety practices.

Our DOT trainers offer a variety of in-person or online training courses tailored to the specific needs or weaknesses of your company.

There is a shortage of commercial truck parking along major interstate corridors in Pennsylvania. Trucks parking on highway shoulders and ramps is common during overnight

What if truckers were educated and equipped to spot and report potential signs of human trafficking to the National Hotline? January is National Human Trafficking

The charging station will allow both Portland General Electric and Daimler to study energy management, charger use and performance, and Daimler vehicles charging performance. First announced in

As we transition from a Republican agenda to a Democrat agenda with Biden coming into office, there is potential for substantial impact within the trucking

Our DOT Compliance Programs ensure it is your top priority and keeps your business running.

Receive the latest transportation and trucking industry information about FMCSA and DOT Audits, Regulations, etc.

There is a shortage of commercial truck parking along major interstate corridors in Pennsylvania. Trucks parking on highway shoulders and ramps is common during overnight

What if truckers were educated and equipped to spot and report potential signs of human trafficking to the National Hotline? January is National Human Trafficking

The charging station will allow both Portland General Electric and Daimler to study energy management, charger use and performance, and Daimler vehicles charging performance. First announced in

Join our monthly newsletter and stay up-to-date on trucking industry news and receive important compliance and licensing tips.

Join our monthly newsletter and stay up-to-date on trucking industry news and receive important compliance and licensing tips.