Furry Friends Cause Trucking Border Delays At Canadian Border

To prevent reintroduction of rabies carried by dogs into the United States, new CDC regulations require proof of healthy pets at border crossing. Truckers who

We are a team of DOT Compliance and Licensing Professionals helping trucking and transportation companies remain safe, compliant, and profitable.

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

A full-scale DOT Compliance Program managing a long haul carrier’s safety, compliance, licensing and more.

Learn more >>>

A DOT Compliance Program that keeps motor carriers compliant with the 6 Basic DOT Regulations required of all carriers.

Learn more >>>

Our Short-Haul/Construction Program is a full-scale program designed for private carriers that do not haul for-hire.

Learn more >>>

Our most comprehensive DOT Compliance Program, operating as your company’s off-site Safety Director or assisting your current safety personnel.

Learn more >>>

Our Non-CDL Program is a full-scale program managing safety, compliance, licensing and more for moving companies, couriers, landscapers, or any company subject to DOT regulations and does not employ CDL drivers.

Learn more >>>

Our DOT Audit Services cover a number of different types of DOT Audits that new and existing carriers will be subject to.

Our DOT Driver Services help trucking companies and carriers to stay compliant as they grow and hire more drivers.

Our DOT Vehicle Services focus on ensuring your vehicles are compliant with DOT Regulations, which is just as important as your drivers.

Our DOT Services for Special Carriers focus on companies outside of the typical motor carrier, like HAZMAT, Passenger and Bus Carriers.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

Our DOT Licensing Services will cover you whether you are an existing company or just starting a trucking company. Our DOT Licensing Specialists can help you get up and running and in days with your DOT number, MC Authority, EIN, UCR, IFTA, 2290 HVUT, Fuel Taxes and can even set you up to get your Commercial Driver's License (CDL) with CNS Driver Training Center.

Our DOT Licensing Specialists will help you with every aspect of starting a trucking company. All you need to do is choose a name for your trucking company.

You will need to ensure your DOT Number, MC Authority, Vehicle Registration, etc. is all set up properly when you start your trucking business.

Our Licensing Specialists can help with all aspects of filing and renewing licenses, fuel taxes, etc.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

To prevent reintroduction of rabies carried by dogs into the United States, new CDC regulations require proof of healthy pets at border crossing. Truckers who

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

CNS Companies is a network of companies specializing in services related to the transportation, manufacturing, construction, service, education and medical industries. Our DOT Compliance division is handled by Compliance Navigation Specialists, CNS Insurance handles Commercial Truck Insurance, CDL training is managed by the CNS Driver Training Center and healthcare is managed by CNS Occupational Medicine.

We are a team of DOT Compliance and Licensing Professionals helping trucking and transportation companies remain safe, compliant, and profitable.

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

A full-scale DOT Compliance Program managing a long haul carrier’s safety, compliance, licensing and more.

Learn more >>>

A DOT Compliance Program that keeps motor carriers compliant with the 6 Basic DOT Regulations required of all carriers.

Learn more >>>

Our Short-Haul/Construction Program is a full-scale program designed for private carriers that do not haul for-hire.

Learn more >>>

Our most comprehensive DOT Compliance Program, operating as your company’s off-site Safety Director or assisting your current safety personnel.

Learn more >>>

Our Non-CDL Program is a full-scale program managing safety, compliance, licensing and more for moving companies, couriers, landscapers, or any company subject to DOT regulations and does not employ CDL drivers.

Learn more >>>

Our DOT Audit Services cover a number of different types of DOT Audits that new and existing carriers will be subject to.

Our DOT Driver Services help trucking companies and carriers to stay compliant as they grow and hire more drivers.

Our DOT Vehicle Services focus on ensuring your vehicles are compliant with DOT Regulations, which is just as important as your drivers.

Our DOT Services for Special Carriers focus on companies outside of the typical motor carrier, like HAZMAT, Passenger and Bus Carriers.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

Our DOT Licensing Services will cover you whether you are an existing company or just starting a trucking company. Our DOT Licensing Specialists can help you get up and running and in days with your DOT number, MC Authority, EIN, UCR, IFTA, 2290 HVUT, Fuel Taxes and can even set you up to get your Commercial Driver's License (CDL) with CNS Driver Training Center.

Our DOT Licensing Specialists will help you with every aspect of starting a trucking company. All you need to do is choose a name for your trucking company.

You will need to ensure your DOT Number, MC Authority, Vehicle Registration, etc. is all set up properly when you start your trucking business.

Our Licensing Specialists can help with all aspects of filing and renewing licenses, fuel taxes, etc.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

To prevent reintroduction of rabies carried by dogs into the United States, new CDC regulations require proof of healthy pets at border crossing. Truckers who

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

CNS Companies is a network of companies specializing in services related to the transportation, manufacturing, construction, service, education and medical industries. Our DOT Compliance division is handled by Compliance Navigation Specialists, CNS Insurance handles Commercial Truck Insurance, CDL training is managed by the CNS Driver Training Center and healthcare is managed by CNS Occupational Medicine.

We wrote an article in the past about 5 Steps to Find Issues in your Fleet Before the DOT.

Well, the 5 steps should all be “read this incredible audit guide” which covers everything you need to know about how carriers are selected for an audit, how to survive an audit, how to fix mistakes found in an audit, how to upgrade from a conditional or unsatisfactory rating after an audit, and how to pass required annual periodic inspections.

NOTE: Big Changes Likely Coming With FMCSA’s Safety Measurement System… Find out more.

What Are CSA Scores and how are they calculated?

CSA scores are a system used by the Federal Motor Carrier Safety Administration (FMCSA) to identify high-risk motor carriers.

Your CSA scores are based on multiple factors called Behavioral Analysis and Safety Improvement Categories or “BASIC” categories. Roadside inspection violations, as well as investigation results, fall under 1 of 7 categories, including:

Data collected over the last 24 month from crash reports, roadside inspections, and DOT interventions are used to calculate a carrier score. The more recent events are weighted more heavily.

Each time you get a violation, depending on the category and severity of the violation, points are added to your CSA scores, and range from 1 to 10 (less to more severe).

The “safety scale percentages” (CSA scores) in each category are compared to other motor carriers with similar registration information and range from 0 to 100 percent. You want your percentage or CSA score to be as low as possible. For example, a 5% score in “vehicle maintenance” means that your company is safer than 95% of motor carriers on the road.

The FMCSA’s Safety Management System (SMS) website makes all data available and is updated on a monthly basis.

To check the full details of your CSA scores, you will need your DOT number and your DOT pin number. This allows you to see “ALERTS,” which are a determining factor of FMCSA audit selections and are issued when a percentage score is over the limit for what the FMCSA considers safe.

You can improve on your CSA scores by putting a system in place to check the BASICs regularly. Determine what categories you need improvement in and put training in place to improve in those particular areas.

Roadside inspections with no violations also cause your scores to lower faster. Violations will reduce in “severity” after 6 months, 13 months, and then are removed from your CSA record completely after 2 years.

If your CSA score is low, you can maintain it by hiring drivers with good PSP scores (the FMCSA pre-employment screening program, includes MVR information and all CSA violations a driver has had for 3 years), providing adequate on-board and recurring training, internal inspections, regular preventative vehicle maintenance, using an ELD solution to avoid maintenance violation, and consequences to drivers who receive violations.

Understanding the CSA Intervention Process and the Importance of Warning Letters.

FMCSA will monitor your safety performance and compliance through its SMS. If you do not improve, they may investigate your company further.

A motor carrier is considered high-risk based on many sources of information, and when they are, the FMCSA wants to understand why.

They seek this understanding through the intervention process.

The CSA intervention process evaluates why safety problems occur, recommends remedies, encourages corrective action, and when necessary, invokes strong penalties for carriers failing to comply.

Let’s dive into the entire process and learn how to be proactive when dealing with the FMCSA.

The FMCSA has three categories of intervention when dealing with a potentially high-risk carrier: Early Contact, Investigation, and Follow-On.

Early Contact

Early Contact usually happens in the form of warning letters or a targeted roadside inspection.

Warning letters alert safety performance and compliance problems to motor carriers early on. If they do not improve their safety metrics after this warning, they may face Offsite or Onsite Investigations.

Targeted Roadside Inspections are usually prompted based on poor safety data scores that are pulled as they approach the scales and can be conducted at a permanent or temporary roadside inspection location.

Investigation

Investigationis the hands-on analysis used to identify safety performance and compliance problems. There are three types of investigations:

Follow-On

Lastly,the Follow-Oncategoryhas four consequences based on a motor carriers investigation result.

Motor carriers must take warning letters seriously as they are the first step in the intervention process.

The FMCSA sends warning letters when safety performance data indicates they are not complying with safety regulations.

These letters identify which Behavior Analysis and Safety Improvement Categories (BASICs) have higher than average safety compliance problems and outlines possible consequences if these problems are not fixed.

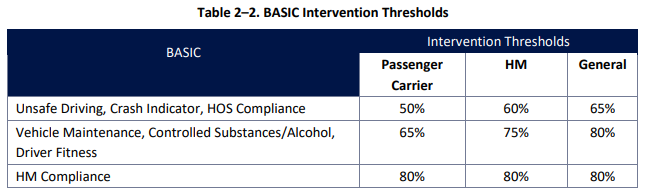

The BASIC “intervention thresholds” were established because they are strong indicators of future crash risk and exceeding them can put you on FMCSA’s priority lists which can later result in fines and violations.

The seven Behavior Analysis and Safety Improvement Categories are:

In Aug 2021, Unsafe Driving intervention threshold was 65% for general carriers, 60% for hazmat, and 50% for passenger carriers.

If a carrier has one or more Acute and/or Critical Violations related to this BASIC, their percentile may increase at or above the intervention threshold.

If you do receive a warning letter, it is your chance to improve your safety performance and compliance without further intervention from the FMCSA.

Read the letter carefully as it:

Motor carriers then need to develop and execute strategies that will make their operations compliant with the safety regulations outlined.

If you do not create a plan now, a future audit investigation may require you to create a Safety Management Plan (SMP) to address corrective action in the key areas of violation.

Preparing For A Comprehensive FMCSA Safety Audit.

A safety audit or compliance review is an examination of a motor carrier’s records in all categories of safety compliance by a safety investigator from the FMCSA.

While there are many different types of audits a carrier can face, the mindset and procedures are similar when preparing for any audit and the best defense is knowledge about what happens in an audit.

Generally, carriers only have about 2 weeks to prepare for an audit. However, following audit preparation best practices and staying organized on a regular basis will prevent any last minute scrambling.

All carriers will inevitably be subject to some type of audit, so it is never too early to prepare, and going above and beyond the DOT compliance requirements will only make this process smoother.

Impressing the DOT auditor and keeping them in a good mood throughout the audit goes a long way.

There are 9 steps of a comprehensive compliance review, which are:

While all recent files must be made available for the auditor to review, they will only look at a sampling of the files and look for the commonly missed items.

However, they will likely start by reviewing drivers that have a red flag violation on file and look closely at every area that has had a previous violation on record.

This is where paying attention to details can mean the difference between passing and failing an audit.

Below are common issues inspectors look for in each step of the compliance review.

Driver Qualification (DQ) Files

When it comes to DQ files, the most common items missing are:

Hours of Service (HOS)

For hours of service, auditors will request all supporting documents, such as bills of lading, fuel receipts, weight tickets, lodging, and more.

If carriers withhold any supporting documents, the violation is weighted the same as having a false log. This is a common area where non-compliant carriers think they can hide information that could prove hours of service violations, but inspectors know what to look for.

Drug and Alcohol

The most common documents missing from drug and alcohol files are:

Another common issue are carries diluting the random drug testing pool by having non-CDL drivers in a CDL-only pool. While this may be an innocent mistake, this reduces the chances of required drivers being randomly selected for a drug test.

Maintenance

There are five areas in a maintenance review, which are:

The auditor will look for any vehicle that was operating with an out-of-service maintenance condition by comparing when a maintenance issue came up and when the repair was fixed.

Now that you understand the common violations found in an FMCSA safety audit, how can you prevent these violations from happening to you?

There are 8 best practices every carrier should prioritize:

Why Carriers and Drivers Need Help When Challenging Violations With The DataQ Process.

In 2019, FMCSA data shows that nearly half of the 54,000 DataQs were filed for inspections/crashes assigned to the wrong carrier or driver (for example, duplicate records in the system).

If you notice incorrect information in your PSP report or the CSA Safety Measurement System (SMS), the DataQ process is there to help companies and drivers fight and remove these records that could be keeping your scores or insurance rates high.

FMCSA says thousands of incorrect information-type DataQs are corrected each year. Just imagine how many incorrect data is left unchecked and hurting your CSA scores right now.

Violation challenges are the number one reason owner-operators utilize the DataQ system, but they are the least-successful category of challenge where only 39% were successfully changed, according to the FMCSA.

The problem with the DataQ process is that navigating the system can be challenging and dealing with state departments’ decisions that are often complex or end up as a single judgment call by the original inspecting officer can be frustrating.

Oftentimes, getting the DOT officer to admit they were wrong is half the battle, but it may take multiple appeals by the carrier to get an in-depth review.

Navigating the system itself can be one challenge, but the most common hurdle is gathering enough evidence to make a convincing case.

Before starting a DataQ process, challengers should make sure they have the officer’s report number for the record being challenged, a police accident report, and any other required or relevant evidence for the case.

Even with clear evidence, fixing errors in the system can be difficult and time consuming when a filing gets rejected.

That whole time, which can take months, the violation is in the CSA score system and damaging your CSA score, insurance rates, and ability to do business.

For crash-related information, only 43% of driver challenges were overturned while carrier service providers, like CNS, have nearly a 60% success rate.

While larger fleets may be able to afford hiring a compliance expert to manage the DataQ process, using a third party to organize a DataQ challenge, review your CSA scores, pull PSP reports, or manage compliance reviews will help you make sure your records are fair and accurate.

Actively managing your safety measurement system (SMS) scores and PSP reports is crucial to the success of Motor Carriers.

As compliance experts, CNS staff are basically doing law enforcement’s job to prove they made a mistake.

We have built great rapport with the FMCSA challenging DataQ’s and have the experience and expertise to determine what can and cannot be challenged.

Our DOT Compliance Specialists are well-versed in the FMCSA rules and regulations, as well as what an officer is required to note on their report.

When filing a challenge, CNS can help you use language that shows intent to be thoughtful, clear, and concise in describing what the error is believed to be.

Whether you would like our DOT Specialists to challenge one DataQ or conduct a monthly analysis of all roadside violations to potentially challenge, we have a cost-effective solution for your company.

We can:

Call one of our DOT Compliance Specialists at 888.260.9448 to discuss your options.

Conditional Rating? Keep Getting Brokers Loads by Providing Proof of Corrective Action.

If you were recently audited and received a conditional or unsatisfactory rating, you will have immediate and long-term consequences beyond the fines from the FMCSA.

Conditional carriers can immediately see less work from brokers, or even be restricted from future loads, while more long-term effects are higher rates for insurance at renewal and new driver prospects may completely avoid applying for a job with your company.

For these reasons, it is crucial to create a corrective action plan (CAP) before your new DOT safety rating goes into effect 60 days after the rating downgrade letter. As long as you have a CAP and show brokers proof of the CAP, you can still get broker loads.

If you already have a conditional and are requesting a safety rating upgrade, just remember that it can take up to 4 months before your corrective action plan is reviewed and upgraded due to your state process, internal staffing issues, etc.

If a carrier fails a safety audit, the FMCSA will provide the carrier written documentation detailing the violations that caused the carrier to fail and the requirements for developing a corrective action plan (CAP).

According to Harry Sanders, retired from the FMCSA, “I think the biggest concern from most carriers that went through an audit and failed was the uncertainty of submitting a CAP and if it was acceptable and changed the rating from fail to pass.”

The CAP must explain the actions the carrier will take to address the violations identified. This is the information brokers want to see to make sure you are being a responsible carrier.

These corrective action plans are complicated and take a lot of work to be completed.

This is where CNS can come in and help you create this plan.

CNS is very well-versed in safety and compliance laws and our experienced representatives know what information is crucial and imperative to accomplish a safety rating increase.

We work with all types of brokers to provide ongoing documentation to keep you running loads until you are officially upgraded.

A few examples of brokers or freight forwards we work with include Coyote, JB Hunt, and CH Robinson.

Contact CNS immediately to represent you in the negotiation process to reduce your penalty and get you a re-payment plan, interest free.

Did you know that nearly 12,000 trucks each month are cited for running without an annual DOT inspection?

To make sure vehicles are safe to operate, the FMCSA requires an annual inspection for every commercial vehicle, including each segment of a combination vehicle, that must be performed by a qualified mechanic, according to 396.17c.

If your truck and trailer pass a Level 1 inspection or a Level 5 DOT inspection by a federal officer, or a qualified periodic state inspection, you can count that as your annual DOT inspection.

Otherwise, motor carriers may perform the annual inspection themselves with a qualified mechanic and the original or copy of the periodic inspection report must be retained by the carrier for 14 months from the report date.

Intermodal equipment providers must also inspect intermodal equipment that is interchanged or intended for interchange to motor carriers in intermodal transportation.

A completed annual inspection form or sticker decal must always be in or on your equipment.

Which state periodic inspections count?

According to the regulations, vehicles passing periodic inspections performed by a State government or equivalent jurisdiction in Canadian Provinces, Yukon Territory, and Mexico, will be considered to have met the requirements of an annual inspection for a period of 12 months commencing from the last day of the month in which the inspection was performed.

The states include:

Note that Arkansas and Oklahoma no longer carry inspection programs that are approved by FMCSA.

If a state inspector makes a mistake for citing your driver for an outside state inspection that you say meets the annual inspection requirements, you can file a DataQ challenge. CNS can help you use language that shows intent to be thoughtful, clear, and concise in describing what the error is believed to be.

[Related: Why You Need Help With The DataQ System And Process]

Who is qualified to perform an annual inspection?

Many larger carriers have a qualified mechanic that can perform an annual inspection. However, most carriers go to a third-party mechanic.

This can include a commercial garage, fleet leasing company, truck stop, or other similar commercial business to perform the inspection, provided that the business operates and maintains facilities appropriate for commercial vehicle inspections and employs qualified inspectors, as required by 396.19.

To be a qualified inspector, they must:

Which vehicles are required for annual inspection and what will they look for?

The following commercial motor vehicles require an annual periodic inspection:

At a minimum, inspections must include all items listed in the Minimum Periodic Inspection Standards, which includes a visual inspection of the vehicle’s exterior and interior, as well as a test of its braking, steering, and lighting systems.

The full inspection list includes:

Annual inspection form and sticker requirements

Once the inspection is completed, the inspector will give you a DOT Annual Inspection Form, which needs to be fully completed, along with the inspector’s Qualified Inspector Form. Some third-party locations has these forms included in their invoice paperwork.

If you don’t receive the qualified inspector form and are later audited by the DOT, they can call the third-party location to verify their qualification.

The completed form or annual inspection decal sticker must always be in or on your equipment.

All commercial vehicles do not require the annual DOT inspection sticker but can be helpful for your trailers. However, carriers can complete these stickers themselves and place them on the inside driver’s side windshield, the bumper near the license plate, or front left of the trailer and closer to the pigtail hookups.

If you are ever pulled in for a DOT Inspection, officers will want you to verify that the vehicles have undergone an annual inspection. They will also ask for proof for each piece of equipment in combination.

Once proof on an annual inspection has been provided, officers will verify that the inspection took place within the last 12 months. If drivers can’t provide proof of an annual inspection, or if an investigation shows the inspection didn’t occur in the last year, the officer will write a citation.

We recommend always having the last two annual inspections in the vehicle as there is a slight overlap with the retention requirement (14 months). Trailers can have a waterproof plastic pouch to keep it on the trailer, but drivers must be aware that it is there if an officer is asking for the information.

If carriers cannot track these inspections, they will get a citation for not doing the annual inspection (396.17) and may also get a citation for not tracking their inspection, repair, and maintenance process well (396.3(b)).

So, be sure to keep a good schedule, no matter if it is on a whiteboard, outlook calendar, in your ELD system, or manila envelopes.

What is IFTA?

Fuel tax recordkeeping and reporting mistakes can bring on an IFTA audit.

The International Fuel Tax Agreement (IFTA) is a multi-jurisdictional fuel tax agreement that simplifies the reporting of fuel taxes by interjurisdictional motor carriers.

In other words, IFTA is a program to collect and distribute fuel tax revenue between states and provinces based upon where the fuel was used, helping carriers by consolidating reporting requirements through the carrier’s home state.

A “qualified motor vehicle” means a motor vehicle used, designed or maintained for transportation of persons or property and:

Under IFTA, motor carriers register with their home state, and receive credentials, which allow them to travel through other IFTA member jurisdictions.

Carriers then file a single quarterly fuel tax return with a single payment to their home state that covers all of their travel in other IFTA member jurisdictions.

The home state then processes the IFTA tax return and forwards funds to each jurisdiction or requests funds for net fuel taxes, so you don’t have to.

IFTA members are responsible for:

Recordkeeping requirements include:

IFTA members are required to preserve the records upon which the quarterly tax return is based for four years from the return due date or filing date, whichever is later, plus any time period included as a result of waivers or jeopardy assessments.

What is an IFTA Audit?

Each IFTA jurisdiction is required to audit 3% of its accounts and can come from random selection or reporting errors.

An audit program is therefore an important and essential compliance measure and ensures that proper revenues are being collected by each jurisdiction.

When your fleet is selected for an IFTA audit, the process will generally look like this:

10 common IFTA mistakes or reoccurring problems with fuel taxes.

Before submitting your quarterly report, check your numbers to make sure there are no data entry errors or inaccurate trip records.

When auditors process fuel taxes, they often come across these ten issues:

If you can resolve these common fuel tax issues, you will be well-prepared for an IFTA audit!

Other important tips:

Fuel tax compliance and management can be difficult, time-consuming, and costly with more and more DOT Audits and IFTA Audits, penalties are exceeding millions of dollars.

We can handle Fuel Tax Permitting and Fuel Tax Compliance for a single owner-operator or fleet of 500 trucks.

The fuel tax service at CNS stands out because it offers carriers these benefits:

The thought of an audit should not scare you if you are prepared. Use your electronic record-keeping as a resource to keep you prepared for any inspection or audit situation.

When your records are accurate and secure, your business will be too!

For more information, contact us at 888.260.9448 or info@cnsprotects.com.

Fuel tax recordkeeping and reporting mistakes can bring on an IFTA audit. Does your trucking company travel across state lines? Then you may have heard

How to keep getting loads and not get dropped by your freight broker. If you were recently audited and received a conditional or unsatisfactory rating,

If you have been in the trucking industry for some time, then you know that some violations have more consequences than others. Negative roadside trends

CSA stands for compliance, safety and accountability. CSA scores are a system used by the Federal Motor Carrier Safety Administration (FMCSA) to identify high-risk motor

Examining problems is crucial for your fleet’s growth. Here’s how to do it. Let’s get real for a second. If you don’t examine your failures,

In 2019, FMCSA data shows that nearly half of the 54,000 DataQs were filed for inspections/crashes assigned to the wrong carrier or driver (for example,

The total number of DOT audits and off-site audits are expected to increase 50% in 2021, compared to last year. The Federal Motor Carrier Safety

Did you receive an email or phone call requesting an FMCSA safety audit or comprehensive compliance review? What is an FMCSA Safety Audit or Compliance

Any time a driver is placed out-of-service at roadside, it increases the chances of a company audit. While a safety audit can occur at any

All fleets should be proactive, not reactive, when it comes to DOT compliance and safety management Fleets that say they care about putting “safety first”

In 2020, the FMCSA and state enforcers may have conducted over 50% of all compliance reviews remotely where just 10% were conducted in 2019 and

Are you prepared for an IFTA Audit? When it comes an audit, the best defense is a great offense. And the best offense is knowledge.

Join our monthly newsletter and stay up-to-date on trucking industry news and receive important compliance and licensing tips.

Join our monthly newsletter and stay up-to-date on trucking industry news and receive important compliance and licensing tips.