Furry Friends Cause Trucking Border Delays At Canadian Border

To prevent reintroduction of rabies carried by dogs into the United States, new CDC regulations require proof of healthy pets at border crossing. Truckers who

We are a team of DOT Compliance and Licensing Professionals helping trucking and transportation companies remain safe, compliant, and profitable.

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

A full-scale DOT Compliance Program managing a long haul carrier’s safety, compliance, licensing and more.

Learn more >>>

A DOT Compliance Program that keeps motor carriers compliant with the 6 Basic DOT Regulations required of all carriers.

Learn more >>>

Our Short-Haul/Construction Program is a full-scale program designed for private carriers that do not haul for-hire.

Learn more >>>

Our most comprehensive DOT Compliance Program, operating as your company’s off-site Safety Director or assisting your current safety personnel.

Learn more >>>

Our Non-CDL Program is a full-scale program managing safety, compliance, licensing and more for moving companies, couriers, landscapers, or any company subject to DOT regulations and does not employ CDL drivers.

Learn more >>>

Our DOT Audit Services cover a number of different types of DOT Audits that new and existing carriers will be subject to.

Our DOT Driver Services help trucking companies and carriers to stay compliant as they grow and hire more drivers.

Our DOT Vehicle Services focus on ensuring your vehicles are compliant with DOT Regulations, which is just as important as your drivers.

Our DOT Services for Special Carriers focus on companies outside of the typical motor carrier, like HAZMAT, Passenger and Bus Carriers.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

Our DOT Licensing Services will cover you whether you are an existing company or just starting a trucking company. Our DOT Licensing Specialists can help you get up and running and in days with your DOT number, MC Authority, EIN, UCR, IFTA, 2290 HVUT, Fuel Taxes and can even set you up to get your Commercial Driver's License (CDL) with CNS Driver Training Center.

Our DOT Licensing Specialists will help you with every aspect of starting a trucking company. All you need to do is choose a name for your trucking company.

You will need to ensure your DOT Number, MC Authority, Vehicle Registration, etc. is all set up properly when you start your trucking business.

Our Licensing Specialists can help with all aspects of filing and renewing licenses, fuel taxes, etc.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

To prevent reintroduction of rabies carried by dogs into the United States, new CDC regulations require proof of healthy pets at border crossing. Truckers who

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

CNS Companies is a network of companies specializing in services related to the transportation, manufacturing, construction, service, education and medical industries. Our DOT Compliance division is handled by Compliance Navigation Specialists, CNS Insurance handles Commercial Truck Insurance, CDL training is managed by the CNS Driver Training Center and healthcare is managed by CNS Occupational Medicine.

We are a team of DOT Compliance and Licensing Professionals helping trucking and transportation companies remain safe, compliant, and profitable.

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

A full-scale DOT Compliance Program managing a long haul carrier’s safety, compliance, licensing and more.

Learn more >>>

A DOT Compliance Program that keeps motor carriers compliant with the 6 Basic DOT Regulations required of all carriers.

Learn more >>>

Our Short-Haul/Construction Program is a full-scale program designed for private carriers that do not haul for-hire.

Learn more >>>

Our most comprehensive DOT Compliance Program, operating as your company’s off-site Safety Director or assisting your current safety personnel.

Learn more >>>

Our Non-CDL Program is a full-scale program managing safety, compliance, licensing and more for moving companies, couriers, landscapers, or any company subject to DOT regulations and does not employ CDL drivers.

Learn more >>>

Our DOT Audit Services cover a number of different types of DOT Audits that new and existing carriers will be subject to.

Our DOT Driver Services help trucking companies and carriers to stay compliant as they grow and hire more drivers.

Our DOT Vehicle Services focus on ensuring your vehicles are compliant with DOT Regulations, which is just as important as your drivers.

Our DOT Services for Special Carriers focus on companies outside of the typical motor carrier, like HAZMAT, Passenger and Bus Carriers.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

Our DOT Licensing Services will cover you whether you are an existing company or just starting a trucking company. Our DOT Licensing Specialists can help you get up and running and in days with your DOT number, MC Authority, EIN, UCR, IFTA, 2290 HVUT, Fuel Taxes and can even set you up to get your Commercial Driver's License (CDL) with CNS Driver Training Center.

Our DOT Licensing Specialists will help you with every aspect of starting a trucking company. All you need to do is choose a name for your trucking company.

You will need to ensure your DOT Number, MC Authority, Vehicle Registration, etc. is all set up properly when you start your trucking business.

Our Licensing Specialists can help with all aspects of filing and renewing licenses, fuel taxes, etc.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

To prevent reintroduction of rabies carried by dogs into the United States, new CDC regulations require proof of healthy pets at border crossing. Truckers who

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

CNS Companies is a network of companies specializing in services related to the transportation, manufacturing, construction, service, education and medical industries. Our DOT Compliance division is handled by Compliance Navigation Specialists, CNS Insurance handles Commercial Truck Insurance, CDL training is managed by the CNS Driver Training Center and healthcare is managed by CNS Occupational Medicine.

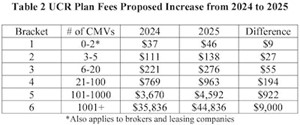

Last year I wrote about how 2024 UCR Fees were reducing 9% (after reducing 31% for 2023) before anticipated increase for 2025.

Well, now we know that the UCR Plan Board is recommending a 25% fee increase for the 2025 registration year, with varying increases between $9 and $9,000 per entity, depending on the applicable fee bracket.

Basically, this is a federal requirement for the UCR Plan to adjust when revenue collections result in a shortfall or surplus from the amount authorized by statute.

However, the recommendations are not all-time high fees as they will still be less than the fees that were in effect in registration years 2019-2022.

FMCSA will accept public comment on the proposed increase for 30 days beginning Tuesday, Jan. 9 at www.regulations.gov by searching Docket No. FMCSA-2023-0268.

The UCR program requires ALL carriers (private, exempt, or for-hire) to register their business with a participating state and pay an annual fee that is based on the size of their fleet.

Brokers, freight forwarders, and leasing companies also are required to register and pay a fee, unless they are also operating as a motor carrier.

Nine non-participating states will not get to enjoy the UCR tax haircut. These states include:

These states that do not participate in the program must enforce UCR requirements for carriers domiciled in those states with DOT numbers.

Use a filing service that knows our industry. Our team can help set up your vehicle registration or your Unified Carrier Registration (UCR).

Our UCR filing service processes your new UCR or your renewal, quickly and accurately. We will file the paperwork and determine the fees, so you can stay focused on your vision for your carrier business.

If you have any questions, call or email CNS at 888.260.9448 or info@cnsprotects.com.

To prevent reintroduction of rabies carried by dogs into the United States, new CDC regulations require proof of healthy pets at border crossing. Truckers who

This means future regulations will “become clearer” or “stuck in the courts” for years. On June 28, 2024, the U.S. Supreme Court overturned the Chevron

ATRI’s Research Advisory Committee (RAC) selected a diverse set of research priorities designed to address some of the industry’s most critical issues including workforce development,

CNS can help with our Roadside & Incident Report Management service where a team of DOT Compliance Specialists will assess the Department of Transportation safety records

Our DOT Compliance Programs ensure it is your top priority and keeps your business running.

Receive the latest transportation and trucking industry information about FMCSA and DOT Audits, Regulations, etc.

To prevent reintroduction of rabies carried by dogs into the United States, new CDC regulations require proof of healthy pets at border crossing. Truckers who

This means future regulations will “become clearer” or “stuck in the courts” for years. On June 28, 2024, the U.S. Supreme Court overturned the Chevron

ATRI’s Research Advisory Committee (RAC) selected a diverse set of research priorities designed to address some of the industry’s most critical issues including workforce development,

Join our monthly newsletter and stay up-to-date on trucking industry news and receive important compliance and licensing tips.

Join our monthly newsletter and stay up-to-date on trucking industry news and receive important compliance and licensing tips.