Furry Friends Cause Trucking Border Delays At Canadian Border

To prevent reintroduction of rabies carried by dogs into the United States, new CDC regulations require proof of healthy pets at border crossing. Truckers who

We are a team of DOT Compliance and Licensing Professionals helping trucking and transportation companies remain safe, compliant, and profitable.

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

A full-scale DOT Compliance Program managing a long haul carrier’s safety, compliance, licensing and more.

Learn more >>>

A DOT Compliance Program that keeps motor carriers compliant with the 6 Basic DOT Regulations required of all carriers.

Learn more >>>

Our Short-Haul/Construction Program is a full-scale program designed for private carriers that do not haul for-hire.

Learn more >>>

Our most comprehensive DOT Compliance Program, operating as your company’s off-site Safety Director or assisting your current safety personnel.

Learn more >>>

Our Non-CDL Program is a full-scale program managing safety, compliance, licensing and more for moving companies, couriers, landscapers, or any company subject to DOT regulations and does not employ CDL drivers.

Learn more >>>

Our DOT Audit Services cover a number of different types of DOT Audits that new and existing carriers will be subject to.

Our DOT Driver Services help trucking companies and carriers to stay compliant as they grow and hire more drivers.

Our DOT Vehicle Services focus on ensuring your vehicles are compliant with DOT Regulations, which is just as important as your drivers.

Our DOT Services for Special Carriers focus on companies outside of the typical motor carrier, like HAZMAT, Passenger and Bus Carriers.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

Our DOT Licensing Services will cover you whether you are an existing company or just starting a trucking company. Our DOT Licensing Specialists can help you get up and running and in days with your DOT number, MC Authority, EIN, UCR, IFTA, 2290 HVUT, Fuel Taxes and can even set you up to get your Commercial Driver's License (CDL) with CNS Driver Training Center.

Our DOT Licensing Specialists will help you with every aspect of starting a trucking company. All you need to do is choose a name for your trucking company.

You will need to ensure your DOT Number, MC Authority, Vehicle Registration, etc. is all set up properly when you start your trucking business.

Our Licensing Specialists can help with all aspects of filing and renewing licenses, fuel taxes, etc.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

To prevent reintroduction of rabies carried by dogs into the United States, new CDC regulations require proof of healthy pets at border crossing. Truckers who

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

CNS Companies is a network of companies specializing in services related to the transportation, manufacturing, construction, service, education and medical industries. Our DOT Compliance division is handled by Compliance Navigation Specialists, CNS Insurance handles Commercial Truck Insurance, CDL training is managed by the CNS Driver Training Center and healthcare is managed by CNS Occupational Medicine.

We are a team of DOT Compliance and Licensing Professionals helping trucking and transportation companies remain safe, compliant, and profitable.

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

A full-scale DOT Compliance Program managing a long haul carrier’s safety, compliance, licensing and more.

Learn more >>>

A DOT Compliance Program that keeps motor carriers compliant with the 6 Basic DOT Regulations required of all carriers.

Learn more >>>

Our Short-Haul/Construction Program is a full-scale program designed for private carriers that do not haul for-hire.

Learn more >>>

Our most comprehensive DOT Compliance Program, operating as your company’s off-site Safety Director or assisting your current safety personnel.

Learn more >>>

Our Non-CDL Program is a full-scale program managing safety, compliance, licensing and more for moving companies, couriers, landscapers, or any company subject to DOT regulations and does not employ CDL drivers.

Learn more >>>

Our DOT Audit Services cover a number of different types of DOT Audits that new and existing carriers will be subject to.

Our DOT Driver Services help trucking companies and carriers to stay compliant as they grow and hire more drivers.

Our DOT Vehicle Services focus on ensuring your vehicles are compliant with DOT Regulations, which is just as important as your drivers.

Our DOT Services for Special Carriers focus on companies outside of the typical motor carrier, like HAZMAT, Passenger and Bus Carriers.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

Our DOT Licensing Services will cover you whether you are an existing company or just starting a trucking company. Our DOT Licensing Specialists can help you get up and running and in days with your DOT number, MC Authority, EIN, UCR, IFTA, 2290 HVUT, Fuel Taxes and can even set you up to get your Commercial Driver's License (CDL) with CNS Driver Training Center.

Our DOT Licensing Specialists will help you with every aspect of starting a trucking company. All you need to do is choose a name for your trucking company.

You will need to ensure your DOT Number, MC Authority, Vehicle Registration, etc. is all set up properly when you start your trucking business.

Our Licensing Specialists can help with all aspects of filing and renewing licenses, fuel taxes, etc.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

To prevent reintroduction of rabies carried by dogs into the United States, new CDC regulations require proof of healthy pets at border crossing. Truckers who

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

CNS Companies is a network of companies specializing in services related to the transportation, manufacturing, construction, service, education and medical industries. Our DOT Compliance division is handled by Compliance Navigation Specialists, CNS Insurance handles Commercial Truck Insurance, CDL training is managed by the CNS Driver Training Center and healthcare is managed by CNS Occupational Medicine.

Many companies, including motor carriers, are now required to report information to FinCEN about the individuals who own or control them, or face fines. Here’s what you need to know.

Starting and running a company includes a lot of registration and important business accounts to be created. Well, there is one more thing to add to the list!

Starting January 1, 2024, the Financial Crimes Enforcement Network (FinCEN) is requiring some basic information to be collected from or reported by many corporations, limited liability companies (LLCs), partnerships, trusts, and other legal entities in hopes of preventing money laundering shell accounts.

While there are exemptions, new and existing trucking businesses are required to go through the new registration process.

Luckily, CNS is here to help break this down and possibly handle this process on your behalf.

Beneficial ownership information refers to identifying information about the individuals who directly or indirectly own or control a company.

In 2021, Congress passed the Corporate Transparency Act that created a new beneficial ownership information reporting requirement.

The new requirement is part of the U.S. government’s efforts to make it harder for criminals to hide from any illegal activity, which in this case involves the laundering of money through a shell company or other opaque ownership structure.

For some time, organized crime has found a way to function by creating small businesses that operate as a front or a shell company so they can launder money. The money is being laundered through a legitimate business to “clean” it, if it was earned from some other illegal activity, like human trafficking operations, drug trade, etc.

These businesses are illegal, inhumane, and undermine the economic growth and security of the United States.

While the Beneficial Owner Information Report process will not singlehandedly stop illegal business interactions, it is a step in the right direction to make such business far more difficult. In the end, it will protect business growth and the well-being of civilians.

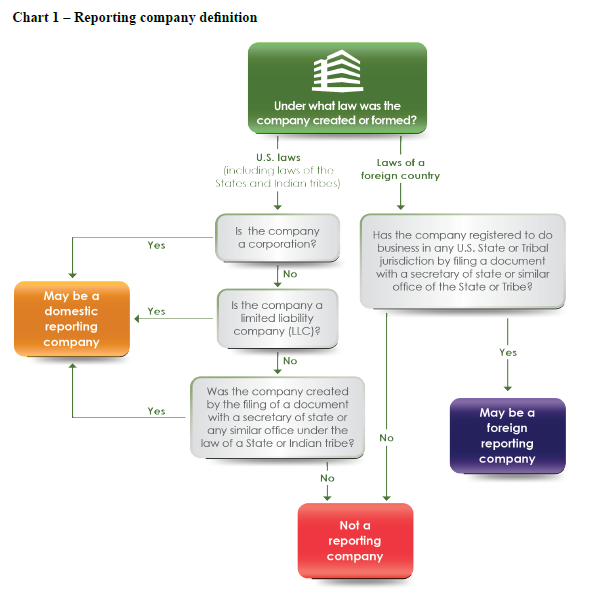

Not all companies are required to report BOI to FinCEN under the Reporting Rule.

Companies are required to report only if they meet the Reporting Rule’s definition of a “reporting company” and do not qualify for an exemption.

Who needs to do this?

FinCEN uses 3 main requirements to determine who must report:

So, first, you need to determine if you fall into the category of a “reporting company”. Look at the chart below, which can help determine if you are considered a domestic or foreign reporting company.

After this, your next step is to identify its beneficial owners. A beneficial owner is any individual who, directly or indirectly:

Note: A reporting company can have multiple beneficial owners.

For example, a reporting company could have one beneficial owner who exercises substantial control over the reporting company, and a few other beneficial owners who own or control at least 25 percent of the ownership interests of the reporting company. A reporting company could have one beneficial owner who both exercises substantial control and owns or controls at least 25 percent of the ownership interests of the reporting company. There is no maximum number of beneficial owners who must be reported.

Our CNS Licensing team can help you do this process on your behalf. If you are interested, fill out the form below… otherwise call us at (888) 260-9448 or email at info@cnsprotects.com.

There are 23 types of entities that are exempt from BOIR requirements (learn more here). These are:

| Exemption No. | Exemption Short Title |

|---|---|

| 1 | Securities reporting issuer |

| 2 | Governmental authority |

| 3 | Bank |

| 4 | Credit union |

| 5 | Depository institution holding company |

| 6 | Money services business |

| 7 | Broker or dealer in securities |

| 8 | Securities exchange or clearing agency |

| 9 | Other Exchange Act registered entity |

| 10 | Investment company or investment adviser |

| 11 | Venture capital fund adviser |

| 12 | Insurance company |

| 13 | State-licensed insurance producer |

| 14 | Commodity Exchange Act registered entity |

| 15 | Accounting firm |

| 16 | Public utility |

| 17 | Financial market utility |

| 18 | Pooled investment vehicle |

| 19 | Tax-exempt entity |

| 20 | Entity assisting a tax-exempt entity |

| 21 | Large operating company |

| 22 | Subsidiary of certain exempt entities |

| 23 | Inactive entity |

As specified in the Corporate Transparency Act, a person who willfully violates the BOI reporting requirements may be subject to civil penalties of up to $500 for each day that the violation continues.

That person may also be subject to criminal penalties of up to two years imprisonment and a fine of up to $10,000.

Potential violations include willfully failing to file a beneficial ownership information report, willfully filing false beneficial ownership information, or willfully failing to correct or update previously reported beneficial ownership information.

Reports will be accepted starting on January 1, 2024, but the deadline for reporting does vary:

Our CNS Licensing team can help you do this process on your behalf. If you are interested, fill out the form below… otherwise call us at (888) 260-9448 or email at info@cnsprotects.com.

Below are some required information for the BOIR:

In addition to filing an initial BOI report, reporting companies must also update and correct information (within 30 days) in their previously filed BOI reports and individuals who obtain FinCEN identifiers must also update and correct information previously reported to FinCEN (within 30 days).

For more information, call (888) 260-9448 or email us at info@cnsprotects.com.

To prevent reintroduction of rabies carried by dogs into the United States, new CDC regulations require proof of healthy pets at border crossing. Truckers who

This means future regulations will “become clearer” or “stuck in the courts” for years. On June 28, 2024, the U.S. Supreme Court overturned the Chevron

EPA’s new truck emission standards will require 25% of new sleeper-cab tractors to be zero-tailpipe-emission trucks by 2032. On March 29, 2024, the U.S. Environmental

Did you know that there have been more than 3.4 million brakes inspected since the program’s inception in 1998? As we prepare for CVSA’s Brake

Our DOT Compliance Programs ensure it is your top priority and keeps your business running.

Receive the latest transportation and trucking industry information about FMCSA and DOT Audits, Regulations, etc.

To prevent reintroduction of rabies carried by dogs into the United States, new CDC regulations require proof of healthy pets at border crossing. Truckers who

This means future regulations will “become clearer” or “stuck in the courts” for years. On June 28, 2024, the U.S. Supreme Court overturned the Chevron

EPA’s new truck emission standards will require 25% of new sleeper-cab tractors to be zero-tailpipe-emission trucks by 2032. On March 29, 2024, the U.S. Environmental

Join our monthly newsletter and stay up-to-date on trucking industry news and receive important compliance and licensing tips.

Join our monthly newsletter and stay up-to-date on trucking industry news and receive important compliance and licensing tips.