How Fleets Can Easily Remove Crash Preventability Off CSA Scores

CNS can help with our Roadside & Incident Report Management service where a team of DOT Compliance Specialists will assess the Department of Transportation safety records

We are a team of DOT Compliance and Licensing Professionals helping trucking and transportation companies remain safe, compliant, and profitable.

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

A full-scale DOT Compliance Program managing a long haul carrier’s safety, compliance, licensing and more.

Learn more >>>

A DOT Compliance Program that keeps motor carriers compliant with the 6 Basic DOT Regulations required of all carriers.

Learn more >>>

Our Short-Haul/Construction Program is a full-scale program designed for private carriers that do not haul for-hire.

Learn more >>>

Our most comprehensive DOT Compliance Program, operating as your company’s off-site Safety Director or assisting your current safety personnel.

Learn more >>>

Our Non-CDL Program is a full-scale program managing safety, compliance, licensing and more for moving companies, couriers, landscapers, or any company subject to DOT regulations and does not employ CDL drivers.

Learn more >>>

Our DOT Audit Services cover a number of different types of DOT Audits that new and existing carriers will be subject to.

Our DOT Driver Services help trucking companies and carriers to stay compliant as they grow and hire more drivers.

Our DOT Vehicle Services focus on ensuring your vehicles are compliant with DOT Regulations, which is just as important as your drivers.

Our DOT Services for Special Carriers focus on companies outside of the typical motor carrier, like HAZMAT, Passenger and Bus Carriers.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

Our DOT Licensing Services will cover you whether you are an existing company or just starting a trucking company. Our DOT Licensing Specialists can help you get up and running and in days with your DOT number, MC Authority, EIN, UCR, IFTA, 2290 HVUT, Fuel Taxes and can even set you up to get your Commercial Driver's License (CDL) with CNS Driver Training Center.

Our DOT Licensing Specialists will help you with every aspect of starting a trucking company. All you need to do is choose a name for your trucking company.

You will need to ensure your DOT Number, MC Authority, Vehicle Registration, etc. is all set up properly when you start your trucking business.

Our Licensing Specialists can help with all aspects of filing and renewing licenses, fuel taxes, etc.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

CNS can help with our Roadside & Incident Report Management service where a team of DOT Compliance Specialists will assess the Department of Transportation safety records

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

CNS Companies is a network of companies specializing in services related to the transportation, manufacturing, construction, service, education and medical industries. Our DOT Compliance division is handled by Compliance Navigation Specialists, CNS Insurance handles Commercial Truck Insurance, CDL training is managed by the CNS Driver Training Center and healthcare is managed by CNS Occupational Medicine.

We are a team of DOT Compliance and Licensing Professionals helping trucking and transportation companies remain safe, compliant, and profitable.

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

A full-scale DOT Compliance Program managing a long haul carrier’s safety, compliance, licensing and more.

Learn more >>>

A DOT Compliance Program that keeps motor carriers compliant with the 6 Basic DOT Regulations required of all carriers.

Learn more >>>

Our Short-Haul/Construction Program is a full-scale program designed for private carriers that do not haul for-hire.

Learn more >>>

Our most comprehensive DOT Compliance Program, operating as your company’s off-site Safety Director or assisting your current safety personnel.

Learn more >>>

Our Non-CDL Program is a full-scale program managing safety, compliance, licensing and more for moving companies, couriers, landscapers, or any company subject to DOT regulations and does not employ CDL drivers.

Learn more >>>

Our DOT Audit Services cover a number of different types of DOT Audits that new and existing carriers will be subject to.

Our DOT Driver Services help trucking companies and carriers to stay compliant as they grow and hire more drivers.

Our DOT Vehicle Services focus on ensuring your vehicles are compliant with DOT Regulations, which is just as important as your drivers.

Our DOT Services for Special Carriers focus on companies outside of the typical motor carrier, like HAZMAT, Passenger and Bus Carriers.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

Our DOT Licensing Services will cover you whether you are an existing company or just starting a trucking company. Our DOT Licensing Specialists can help you get up and running and in days with your DOT number, MC Authority, EIN, UCR, IFTA, 2290 HVUT, Fuel Taxes and can even set you up to get your Commercial Driver's License (CDL) with CNS Driver Training Center.

Our DOT Licensing Specialists will help you with every aspect of starting a trucking company. All you need to do is choose a name for your trucking company.

You will need to ensure your DOT Number, MC Authority, Vehicle Registration, etc. is all set up properly when you start your trucking business.

Our Licensing Specialists can help with all aspects of filing and renewing licenses, fuel taxes, etc.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

CNS can help with our Roadside & Incident Report Management service where a team of DOT Compliance Specialists will assess the Department of Transportation safety records

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

CNS Companies is a network of companies specializing in services related to the transportation, manufacturing, construction, service, education and medical industries. Our DOT Compliance division is handled by Compliance Navigation Specialists, CNS Insurance handles Commercial Truck Insurance, CDL training is managed by the CNS Driver Training Center and healthcare is managed by CNS Occupational Medicine.

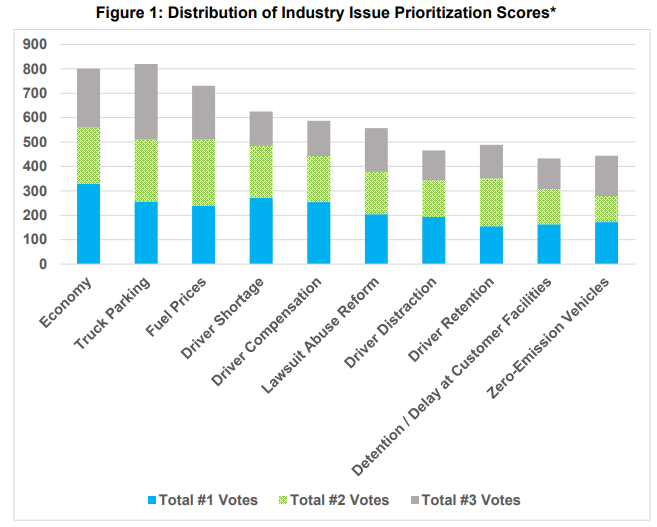

Aggressive mandates to transition fleets to zero-emission vehicles put issue on top 10 concern list for the first time, ranking 10th overall and 7th among motor carrier respondents.

Beyond the trucking economy, the industry has faced a year of disruptions, including new state and federal mandates with hopes to transition fleets to zero-emission vehicles.

For example, CARB’s Advanced Clean Truck Regulation would require that by 2045, every truck sold in state’s that automatically adopt CARB regulations (like Pennsylvania) be zero-emission.

Today, there are 16 other states who have either adopted, or are in the process of adopting, California’s strict emissions standards.

The trucking industry is taking notice.

On Saturday, the American Transportation Research Institute (ATRI), released its 2023 Top Industry Issues report, identifying the leading industry concerns.

According to ATRI respondents, the top concerns are:

The report surveyed more than 4,000 trucking industry stakeholders including industry professionals, motor carrier executives, truck drivers, industry suppliers, law enforcement, and more.

“ATRI’s list thoroughly and accurately reflects the challenges we’ve faced this year,” said ATA Chairman Dan Van Alstine, Ruan Transportation Management Systems President and COO. “Costs were up and demand was down, all while we worked to navigate a number of workforce and regulatory issues. Thankfully, ATRI’s analysis doesn’t just tell us what the issues are, it spells out a number of data-driven strategies that the industry can pursue to address them.”

For the first time ever, zero-emission vehicles (ZEV) made the Top 10 list of industry concerns.

The issue surrounds the quick push by mandates to encourage or force fleets to adopt low-emission semis, which are expensive and there is a lack of charging infrastructure nationwide.

Related article: Why move away from diesel to EV semis?

Let’s take a closer look at the concerns.

Lack of semi-EV charging infrastructure

On Feb 28, 2023, DOT released a final rule on the National Electric Vehicle Infrastructure Standards and Requirements.

The rule does not prohibit the Medium Duty/Heavy Duty Vehicles charging infrastructure but it also did not provide how to manage this transition to EV fleets.

While many medium-duty vehicles will likely charge at fleet depots and operate under hub-and-spoke business models where they would not venture significant distances from their base locations, a growing sector of MD/HD vehicles will require on-corridor charging.

Some commenters on the final rule suggested that requirements be designed to consider the future accommodation of power demands, site use/circulation needs, and set a certain number of federally-funded EV charging parking spaces be designed to accommodate MD/HD needs for long-haul trucking.

What about minimum power levels for MD/HD electric vehicle charging?

The final rule concluded that the provision of multiple levels of power availability at charging stations would detract from the goal of standardization and from the ability to deliver a convenient, affordable, reliable, and equitable solution for EV charging.

The government will continue to monitor the technological advancements in inductive and catenary charging for consideration as to whether further regulation is needed to provide applicable minimum standards and requirements at a future date.

ATRI’s 2023 top issues report documented that full electrification of the U.S. vehicle fleet would require over 40 percent of the country’s existing electricity generation and in some states, like California, that percentage would near 60 percent.

That same research found that equipping the nation’s truck parking spaces with chargers would require an initial deployment cost topping $35 billion.

Understanding these impacts and their associated cost increases across the supply chain is the preferred strategy of 53.8 percent of respondents.

Fleet investment and Federal Excise Tax

According to ATRI, 22.7 percent of respondents believe that the best approach for addressing Zero-Emission Vehicles is to understand how a repeal of the Federal Excise Tax (FET) would impact the industry’s environmental footprint as fleets invested in newer equipment.

The 12% tax is among the highest percentage of any excise tax currently levied on a product.

Additionally, with CARB, it will cost more to buy California-compliant trucks with extended warranties.

For example, Peters Brothers does not want to purchase extended California warranties for its new trucks. Peters Brothers replace approximately 13 trucks each year, which means they must pay a huge chunk of extra money for warranties the company neither wants nor needs. This added burden alone has the family reluctantly, but seriously, considering buying their trucks in Wisconsin, where they have another hub.

More research on fleet safety with EV semis

ATRI’s report also calls for more research on the impacts of battery-electric vehicles to crash response and first responder safety.

While smaller battery electric vehicles have less fire issues than traditional cars, the fear of MD/HD vehicle battery vehicles fires are a significant concern among first responders.

Lastly, respondents are concerned about the increased risk of severe injury and death for all road users from heavier curb weights and the increasing size, power, and performance of electric vehicles.

Fuel prices ranked third in top industry concerns

With year-over-year increases in the fuel cost per mile of 53.7 percent and fuel representing 28 percent of the total operating costs, the highest since 2014, fuel remains a top industry concern.

While prices seemed to be on a decreasing trend, the war in Israel is causing fear of coming swings in oil prices.

Most respondents (68.0%) believe the best approach for addressing high fuel prices is to stabilize the nation’s fuel supply through federal action, whether that be expanding refining capacity, increasing domestic drilling, or continuing to tap the Strategic Petroleum Reserve (SPR).

Additionally, some respondents believe the best approach includes alternative and renewable fuels. Part of the challenge in doing so is the limited penetration of these alternate fuel sources in the combination vehicle market.

Just 8.2 percent of respondent fleets have one or more Class 8 truck-tractor powered by an alternative fuel source (for example, compressed natural gas or CNG) and 5% with a battery-electric vehicle.

At CNS, our DOT Compliance Programs focus on Proactive Safety Management (PSM), a mindset that will ensure your fleet’s safety and compliance is always in order and ahead of the FMCSA.

Our PSM Motor Carrier Program includes:

CNS can help with our Roadside & Incident Report Management service where a team of DOT Compliance Specialists will assess the Department of Transportation safety records

Do you travel in or through British Columbia, Canada? There is now a speed limiter requirement affecting most heavy trucks, as of Friday April 5,

If your lights aren’t on at night, but they work, that’s no longer an OOS violation, though it’s still a violation of state laws to

California’s AB5 legal battles, that cover an estimated 70,000 owner-operators, lose another chance to block the rule. The AB5 law makes it more difficult for

Our DOT Compliance Programs ensure it is your top priority and keeps your business running.

Receive the latest transportation and trucking industry information about FMCSA and DOT Audits, Regulations, etc.

CNS can help with our Roadside & Incident Report Management service where a team of DOT Compliance Specialists will assess the Department of Transportation safety records

Do you travel in or through British Columbia, Canada? There is now a speed limiter requirement affecting most heavy trucks, as of Friday April 5,

If your lights aren’t on at night, but they work, that’s no longer an OOS violation, though it’s still a violation of state laws to

Join our monthly newsletter and stay up-to-date on trucking industry news and receive important compliance and licensing tips.

Join our monthly newsletter and stay up-to-date on trucking industry news and receive important compliance and licensing tips.