Furry Friends Cause Trucking Border Delays At Canadian Border

To prevent reintroduction of rabies carried by dogs into the United States, new CDC regulations require proof of healthy pets at border crossing. Truckers who

We are a team of DOT Compliance and Licensing Professionals helping trucking and transportation companies remain safe, compliant, and profitable.

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

A full-scale DOT Compliance Program managing a long haul carrier’s safety, compliance, licensing and more.

Learn more >>>

A DOT Compliance Program that keeps motor carriers compliant with the 6 Basic DOT Regulations required of all carriers.

Learn more >>>

Our Short-Haul/Construction Program is a full-scale program designed for private carriers that do not haul for-hire.

Learn more >>>

Our most comprehensive DOT Compliance Program, operating as your company’s off-site Safety Director or assisting your current safety personnel.

Learn more >>>

Our Non-CDL Program is a full-scale program managing safety, compliance, licensing and more for moving companies, couriers, landscapers, or any company subject to DOT regulations and does not employ CDL drivers.

Learn more >>>

Our DOT Audit Services cover a number of different types of DOT Audits that new and existing carriers will be subject to.

Our DOT Driver Services help trucking companies and carriers to stay compliant as they grow and hire more drivers.

Our DOT Vehicle Services focus on ensuring your vehicles are compliant with DOT Regulations, which is just as important as your drivers.

Our DOT Services for Special Carriers focus on companies outside of the typical motor carrier, like HAZMAT, Passenger and Bus Carriers.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

Our DOT Licensing Services will cover you whether you are an existing company or just starting a trucking company. Our DOT Licensing Specialists can help you get up and running and in days with your DOT number, MC Authority, EIN, UCR, IFTA, 2290 HVUT, Fuel Taxes and can even set you up to get your Commercial Driver's License (CDL) with CNS Driver Training Center.

Our DOT Licensing Specialists will help you with every aspect of starting a trucking company. All you need to do is choose a name for your trucking company.

You will need to ensure your DOT Number, MC Authority, Vehicle Registration, etc. is all set up properly when you start your trucking business.

Our Licensing Specialists can help with all aspects of filing and renewing licenses, fuel taxes, etc.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

To prevent reintroduction of rabies carried by dogs into the United States, new CDC regulations require proof of healthy pets at border crossing. Truckers who

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

CNS Companies is a network of companies specializing in services related to the transportation, manufacturing, construction, service, education and medical industries. Our DOT Compliance division is handled by Compliance Navigation Specialists, CNS Insurance handles Commercial Truck Insurance, CDL training is managed by the CNS Driver Training Center and healthcare is managed by CNS Occupational Medicine.

We are a team of DOT Compliance and Licensing Professionals helping trucking and transportation companies remain safe, compliant, and profitable.

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

A full-scale DOT Compliance Program managing a long haul carrier’s safety, compliance, licensing and more.

Learn more >>>

A DOT Compliance Program that keeps motor carriers compliant with the 6 Basic DOT Regulations required of all carriers.

Learn more >>>

Our Short-Haul/Construction Program is a full-scale program designed for private carriers that do not haul for-hire.

Learn more >>>

Our most comprehensive DOT Compliance Program, operating as your company’s off-site Safety Director or assisting your current safety personnel.

Learn more >>>

Our Non-CDL Program is a full-scale program managing safety, compliance, licensing and more for moving companies, couriers, landscapers, or any company subject to DOT regulations and does not employ CDL drivers.

Learn more >>>

Our DOT Audit Services cover a number of different types of DOT Audits that new and existing carriers will be subject to.

Our DOT Driver Services help trucking companies and carriers to stay compliant as they grow and hire more drivers.

Our DOT Vehicle Services focus on ensuring your vehicles are compliant with DOT Regulations, which is just as important as your drivers.

Our DOT Services for Special Carriers focus on companies outside of the typical motor carrier, like HAZMAT, Passenger and Bus Carriers.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

Our DOT Licensing Services will cover you whether you are an existing company or just starting a trucking company. Our DOT Licensing Specialists can help you get up and running and in days with your DOT number, MC Authority, EIN, UCR, IFTA, 2290 HVUT, Fuel Taxes and can even set you up to get your Commercial Driver's License (CDL) with CNS Driver Training Center.

Our DOT Licensing Specialists will help you with every aspect of starting a trucking company. All you need to do is choose a name for your trucking company.

You will need to ensure your DOT Number, MC Authority, Vehicle Registration, etc. is all set up properly when you start your trucking business.

Our Licensing Specialists can help with all aspects of filing and renewing licenses, fuel taxes, etc.

CNS is part of a group of companies that offer other necessary services for the trucking and transportation industry, such as Commercial Trucking Insurance, CDL Training, Online Training Course, and even Healthcare.

To prevent reintroduction of rabies carried by dogs into the United States, new CDC regulations require proof of healthy pets at border crossing. Truckers who

CNS or Compliance Navigation Specialists is DOT Compliance company that assists trucking and transportation companies remain DOT Compliant. We are part of a network of companies, CNS Companies, specializing in services related to the transportation, manufacturing, construction, service, education and medical industries.

CNS Companies is a network of companies specializing in services related to the transportation, manufacturing, construction, service, education and medical industries. Our DOT Compliance division is handled by Compliance Navigation Specialists, CNS Insurance handles Commercial Truck Insurance, CDL training is managed by the CNS Driver Training Center and healthcare is managed by CNS Occupational Medicine.

In 2021, according to ATRI’s “Analysis of the Operational Costs of Trucking” report, the cost of trucking increased to its highest level ever in the 15-year history.

This was due to atypical market conditions, such as the rise in fuel costs and the pandemic’s supply chain issues. These issues only got worse in the first half of 2022 with the Ukraine and inflation crisis.

However, the report did have some upsides when it comes to trucking efficiency.

The below links are more important details on the topics we cover in this article:

In a tight economy, carriers and drivers need to reduce unnecessary costs, focus on preventative maintenance, and reduce any deadhead miles.

Deadhead mileage, also known as “backhaul” or “empty miles,” is one of the most important impediments to operational efficiency because these miles incur costs without generating a revenue stream.

Under the pressure of rising fuel prices, carriers achieved some of the lowest deadhead mileage in years.

The NPTC report attributed this improved efficiency to the decline of long haul in the sector as well as the need to carry returns or dunnage.

From a driving perspective, it is more important than ever to encourage proper trip planning because a well-planned trip is profitable.

A poorly planned route can have seriously negative impacts, such as:

READ MORE: 12 TIPS FOR PROPER TRIP PLANNING AND JOURNEY MANAGEMENT

Typically, fuel is the largest operating costs in a trucking company and the average truck today can consume more than 20,000 gallons of fuel a year, costing more than $70,000.

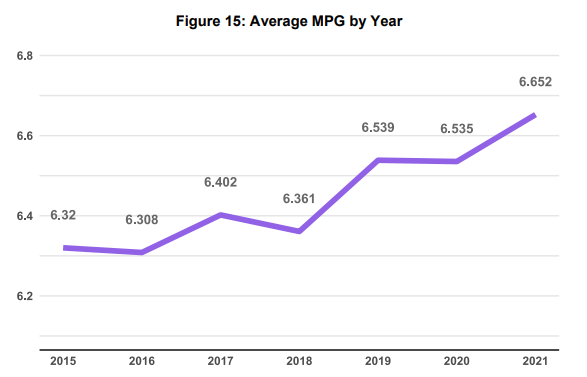

In 2021, fuel economy continued its general trend of improvement with average truck-tractor miles per gallon (MPG) being 6.652.

Fuel economy varies based on a tractor-trailer’s total operating weight, which includes cargo as well as tractor and trailer weights. Table 17 provides average respondent MPG for each average operating weight class.

According to the American Trucking Association, drivers who practice fuel-efficient driving techniques use about 35% less fuel than those who do not.

READ MORE: HOW TRUCK DRIVERS CAN OPTIMIZE FUEL EFFICIENCY

When you accept a load you may receive a fuel heat map, and/or suggested fuel stops, to keep your costs down. Plan ahead, as a thrifty driver can save .10 per gallon or more from one state to another.

Additionally, proper truck driver route planning also includes not over-fueling before a weigh station or inspection point. You don’t want a chance of running overweight.

Plan your fuel stops ahead of time and use fuel rewards programs to save money.

Speed governors contribute to fuel efficiency, and for this reason their use tends to rise with fuel prices.

In 2021, 94 percent of respondents used speed governors on some or all of their trucks, compared with just 81 percent in 2020.

Even small carriers, which often refrain from using them, joined this trend: 82 percent of fleets with 25 or fewer trucks used speed governors in 2021, whereas only 50 percent used them in 2020.

The Federal Motor Carrier Safety Administration’s (FMCSA) has released a notice of intent to proceed with rulemaking to mandate speed limiters on most heavy-duty trucks, restarting a process that had been dormant for six years.

Right now, there is no suggestion on what the speed-limiter should be set for, such as 65mph, 68 mph, or 75mph and, if a rule is submitted, we will likely not see it affect drivers until 2024-2026.

The ATRI report is also measuring new efficiency metrics, such as annualized driver turnover, average dwell time at shipper facilities, and revenue per truck.

Dwell time is when drivers are waiting at shipper and receiver facilities.

Though loading or unloading freight necessarily expends time, driver detention or dwell time occurs when shippers or receivers lock up trucks outside of loading/unloading periods. In 2021, drivers rated this issue as their second-highest concern.

While mega fleets spent 46 fewer minutes at shipper and receiver facilities than the smallest fleets, dwell time is a significant drain on operating hours for fleets of all size.

It will be interesting to watch these metrics moving forward and see if the FMCSA can find ways to reduce these wait times in the years to come.

Carriers being proactive will put them in a better position to mitigate risk, improve efficiencies, reduce costs, and spend more time with their drivers in an effort to manage a safe and compliant fleet.

Not only will proactive safety help your fleet with DOT compliance, but it is proven to lower insurance premiums as you will have documented ways to show a reduction in risk.

Our safety management programs are perfect for combining multiple services and can be tailored to fit your needs, whether you are a new owner operator or a seasoned trucker or business owner.

At CNS, our DOT Compliance Programs focus on Proactive Safety Management (PSM), a mindset that will ensure your fleet’s safety and compliance is always in order and ahead of the FMCSA.

Our PSM Motor Carrier Program includes:

ATRI’s Research Advisory Committee (RAC) selected a diverse set of research priorities designed to address some of the industry’s most critical issues including workforce development,

Distracted driving is a major issue among all types of drivers but is an especially important concern for commercial motor vehicle drivers as it can

Driving in road construction areas can be among the most dangerous type of driving you will encounter. Spring means warmer weather is here and construction

Motor carriers are responsible for ensuring that drivers are not operating while ill or fatigued. However, motor carriers, at their discretion, may authorize their drivers

Our DOT Compliance Programs ensure it is your top priority and keeps your business running.

Receive the latest transportation and trucking industry information about FMCSA and DOT Audits, Regulations, etc.

ATRI’s Research Advisory Committee (RAC) selected a diverse set of research priorities designed to address some of the industry’s most critical issues including workforce development,

Distracted driving is a major issue among all types of drivers but is an especially important concern for commercial motor vehicle drivers as it can

Driving in road construction areas can be among the most dangerous type of driving you will encounter. Spring means warmer weather is here and construction

Join our monthly newsletter and stay up-to-date on trucking industry news and receive important compliance and licensing tips.

Join our monthly newsletter and stay up-to-date on trucking industry news and receive important compliance and licensing tips.